Information was last updated in May 2021 in accordance with changes in the law.

When it comes to cruising in the Mediterranean Sea and visiting the charming little villages along the coast is doubtless a dream of all yacht lovers where a yacht owner or seller will guide you that there are more to owning a yacht than what meets the eye. The next step after acquiring your yacht will be to register the vessel under a flag of a preferred jurisdiction. As a yacht owner, it is in your best interest to choose a jurisdiction which is fiscally competitive and highly accessible, yet reputable.

Malta has also developed a very strong legal and regulatory platform that has enabled the Malta flag to become a reputable international ship register which is now established as one of the largest in the world.

Income Tax Exemptions

- A shipping organisation is exempt from tax on any income derived from shipping activities and any income or gains derived from the sale or other transfer of a tonnage tax ship or from the disposal of any rights to acquire a ship which when delivered or completed would qualify as a tonnage tax ship. “Shipping activities” comprises the international carriage of goods or passengers by sea or the provision of other services to or by a ship as may be ancillary thereto or associated therewith including the ownership, chartering or any other operation of a ship and includes also ship management activities of a ship manager.

- Any gains arising upon the liquidation, redemption, cancellation, or any other disposal of shares, securities or any other interest, including goodwill, held in any licensed shipping organisation owning, operating, administering or managing a tonnage tax ship while she was a tonnage tax ship are exempt from tax in Malta.

- No Malta tax is charged upon any payments of interest or other income in relation to the financing of the operations of shipping organisations or the financing of any tonnage tax ship.

- No tax is chargeable upon dividends distributed by a shipping organisation to its shareholders, out of profits derived from shipping activities.

VAT-Efficient Finance Leasing Structure

In March 2020, the Commissioner for Revenue issued guidelines in relation to VAT treatment of pleasure yacht leasing to better reflect the EU’s development and practices. The updated guidelines offer yacht owners the possibility of setting up attractive operational lease models, resulting in cash flow advantages and overall VAT optimization.

The guidelines are based on the principle of ‘use and enjoyment’, whereby Maltese VAT at the standard rate of 18 per cent is charged on the portion of the lease covering the actual use and enjoyment of the yacht within EU waters, whereas no VAT is applicable when the yacht is effectively used and enjoyed within non-EU or international waters. The application of such principle, therefore, implies that the overall VAT incidence shall depend on the whereabouts of the yacht.

The lessor of a pleasure boat shall calculate the actual effective use and enjoyment by the lessee of the pleasure boat outside EU waters when it is possible to identify the place of effective use and enjoyment outside EU waters. For the purpose of such calculation, the lessor shall utilise such documentary and/or technological data (including logs retained by the master of the pleasure boat as well as any GPS/AIS data) as the lessor can reasonably obtain from the lessee.

In order to apply such VAT treatment on the actual use and enjoyment of the yacht, several general conditions and anti-abuse measures need to be satisfied, including:

- Lessor must be a shipping company registered for VAT purposes in Malta;

- Lessee must be a non-taxable person; in other words, the yacht must be used by the lessee for non-business purposes;

- A yacht leasing agreement must be entered into between the lessor and the lessee, which must be for more than 90 days and which agreement must be at arm’s length and presented to the VAT Department;

- Written approval on the application of the effective use and enjoyment principle must be obtained from the VAT Department;

VAT Treatment of Short-term Charters

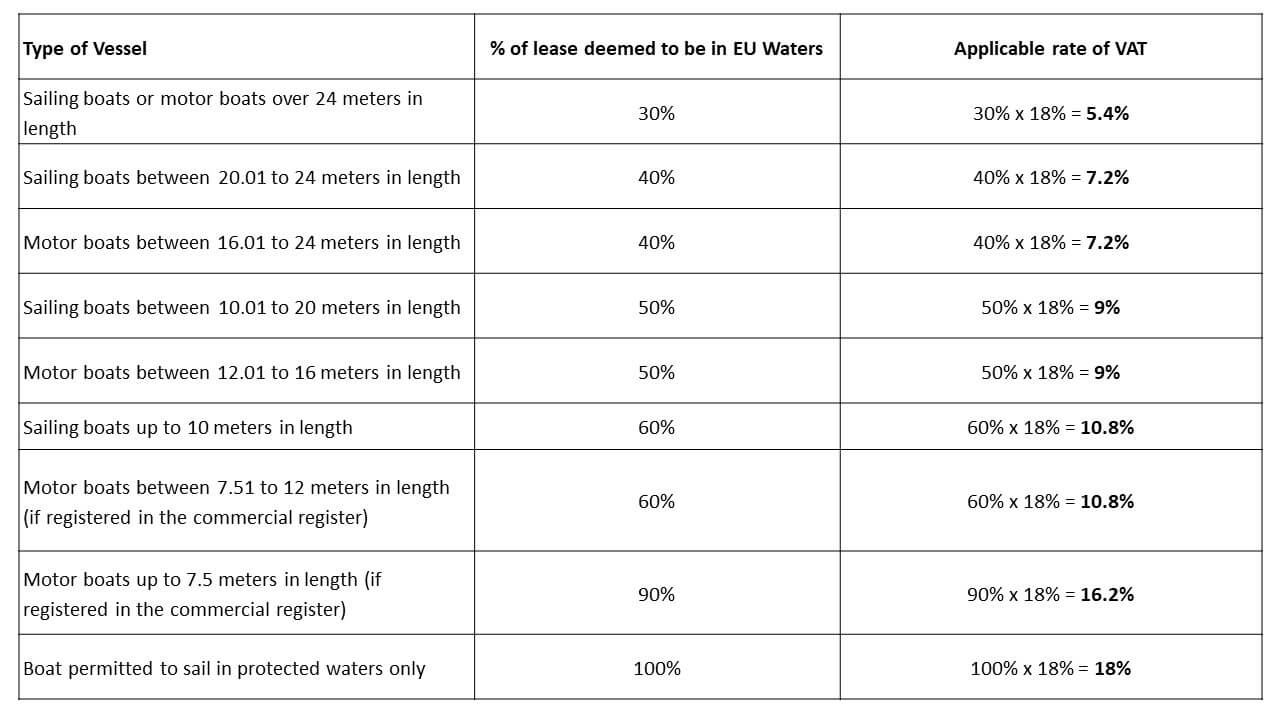

Primarily a short-term charter is a charter for not more than 90 days, where a yacht is chartered for leisure purposes. In such case, the percentage of the lease which is deemed to be held in EU waters is calculated according to the size of the yacht follows;

Registration Procedure

Any type of marine vessel, be it large cruise lines, supertankers or private yachts may be registered in Malta. Yachts, depending on their intended use, can be registered under the Maltese flag, as private pleasure yachts or commercial yachts.

Visit our Yacht registration page for a detailed description of the procedure for vessel registration under the Malta flag.

Eligibility for registration

All types of vessels, from pleasure yachts to oil rigs, including vessels under construction, may be registered, provided that, inter alia, they are wholly owned by legally constituted corporate bodies or entities irrespective of nationality, or by European Union citizens.

The formation of a Maltese company is a straightforward operation as there are no nationality requirements as to both the shareholders and directors.

As a rule, trading ships of 25 years and over are not registered although in certain circumstances this may be considered.

Ships of 15 years and over are required to undergo successfully an authorized flag State inspection prior to provisional registration.

Ships of 10 years and over but under 15 years are required to undergo successfully an inspection by an authorized flag State inspector before or within one month of provisional registration.

Benefits of flying a Maltese Flag

Once successfully registered under the Malta flag, a yacht can also benefit from the excellent international repute of the flag, which is further enhanced by Malta’s membership within the European Union.

- Yachts may be registered on behalf of legally constituted corporate bodies or entities irrespective of nationality.

- Twenty-four hour, seven days a week service in response to urgent matters.

- Low company formation, ship registration and tonnage tax costs.

- Maltese law provides for the registration of yachts that are being built or equipped.

- Attractive tax incentives to yachts and superyachts owners encouraging commercial operation.

- No restrictions on the sale or mortgaging of Maltese registered yachts and superyachts.

- A dynamic registration with one of the largest ship registers in the world and very active in EU for and international organization such as the IMO.

- A sovereign state, member of the European Union with political, fiscal and social stability.

- The registration of a body corporate in Malta to own or operate a ship is a relatively straightforward operation and Maltese ship-owning companies operate in a relatively restriction-free environment. For example:

- There are no trading restrictions and there is preferential treatment to Maltese ships in certain ports.

- There is a complete tax exemption to owners, charterers, and financiers of Maltese or Community (including EEA) ships of over 1,000 net tons (exempted ships).

- Furthermore, no tax is payable on dividends paid to the shareholders.

SMM Group focuses its expertise for any Yacht owner to obtain a Maltese flag hassle-free and by providing all supported legal services through and fort.

Get in touch with us to register under the Maltese flag. Our experts can be reached on +356 2123 7167 or via email at info@smmgroup.com.mt